How to Buy a Car as an IMG in the UK

When you decide to make the decision to buy a car in the UK as an IMG, there are a lot of things that need to be weighed. It is not something you should rush into without knowing every aspect of what it entails, especially as an IMG who may otherwise be unaware of all the rules and regulations associated with a purchase or a lease.

Do I need a car?

If you buy a car in the UK, it definitely comes with a sense of pride and accomplishment. It’s a status symbol, which is why many flocks to own one as soon as they are pulling enough down per month to pay it off and have a driver’s license. What we often fail to take into account is if we actually need a car at the stage we are at and if instead, it may make more sense to wait for when it would be more appropriate.

In a lot of the United Kingdom’s bigger cities, parking is hard to come by (or at the very least, expensive), with many residents opting for public transport for their day to day travel. If you are living somewhere that has many options for transport that are convenient for you and/or you don’t live too far from your hospital, you may realize that a car is not the first priority.

That being said, if you are in a relatively small town where basic amenities are spaced out and/or you have to travel a significant distance to get to work, you may consider buying a car. Having young children may also influence your decision.

Should I buy or lease a car in the UK?

There are many different ways you can go about having a sweet ride:

- Hire purchase (HP)

- Personal contract hire (PCH)

- Personal contract purchase (PCP)

- Personal loan

- Cash

Hire Purchase (HP)

A hire purchase is a lease, so you are financing this car for your use. You need to put down a deposit (generally 10% of the car price) and then you are left with monthly payments over a period of time that is decided between you and the car dealership. Naturally, there will be interest added to these monthly payments, so the longer the duration of the contract, the more interest paid back.

Hire purchases typically don’t come with a mile restriction, but the monthly payments may be higher than that for a PCP or PCH. At the end of your contract, you have an ‘option to buy’ which can come at an added cost, but then the car would be yours. Usually, this fee is £100-200, but it can be more.

Since you are essentially using the car as collateral, if you fail to pay your instalments, the car can be repossessed. That being said, if you don’t have a good credit score, you are more likely to get approved for a hire purchase versus a PCP, where they conduct a credit check.

So let’s look at an example! Let us assume you are looking to set up a hire purchase on a car that costs £40,490, with a 4.9% APR over 36 months. Your deposit would be £4,049 (10% of the car price), and you’d be looking at around £1,089 per month (a total of £39,204) as your payment. If you choose not to purchase the car, the money has gone into your rental and that would be the end of it.

Know that you don’t have to take the first APR offered to you and that you can also try and negotiate the price of the car. Also that the higher the deposit, the less the monthly payment. Lastly, remember that while it may seem tempting to take out a payment plan that is longer as it comes with a lower payment per month, the interest added on top would increase your overall cost.

Personal Contract Hire (PCH)

If you want to drive a car that you’re unlikely to then want to buy at the end of the contract term, a PCH may be right for you. What happens here is that you lease the car you want for an agreed-upon duration, put down a deposit, and pay a fee every month. There will be a mileage limit that will be decided upon when you sign the initial contract.

Monthly payments for PCH tend to be cheaper versus that of a PCP but remember that the money you are putting into the PCH does not go towards owning the car. You will need to undergo a credit check and there is a penalty if you wish to break your contract early. If you’re looking to take out a relatively expensive car for a certain amount of time, but don’t want to invest as much as you’d need to in order to buy a car in the UK, a PCH is ideal.

Now let’s look at an example. Perhaps the car you are looking at is worth £40,490. £10,000 goes as a deposit/down payment, and you agree upon your mileage limit (increasing your limit will increase your monthly payment). And then finally you decided you want the duration of your contract to be 36 months. All in all, you would be paying £295 a month, which would be £10,620 at the end of your contract, with a total amount invested as £20,620.

Personal Contract Purchase (PCP)

Yet another loan, you don’t have to own the car you’ve been paying into at the end of your contract, but you have the option to do so if you want. The first thing that would be decided upon is the balloon payment or the guaranteed minimum future value (GMFV). This is the future predictive value of the car at the end of your contract. You don’t have to worry about this valuation unless you intend on buying the car.

You again are going to have to put down a deposit (usually 10%), and then work out a duration for the contract, and see what APR you’d be looking at to pay. The GMFV is what is paid off by you if you intend to keep the car, but the money you are putting in is calculated based on what the car is worth right now and the depreciation plus interest. Keep in mind that there is a mileage limit.

Now for an example! Let’s say that the car costs £40,490 and the GMFV is calculated to be £20,000. So you’d need the loan to be on the original value (£40,490) minus the down payment. Let’s say you’d put £4,000 down. This then means you are actually looking to repay £16,000 (plus the interest for the entire £36,490) for 36 months, with a 4.9% APR.

At the end of your contract, you can either pay the GMFV to keep the car, or hand it back. You also have the option to take out a new car. If when you deal is finished, the car is still worth more than the GMFV, you can use that equity as a deposit on a new PCP deal. Unfortunately you cannot take this equity as cash and walk away, but if the actual value ends up being £22,000 for a GMFV of £20,000, you now have £2,000 to put towards a new plan.

Don’t worry if the valuation is less than the GMFV. That is the dealership’s headache. What you need to keep in mind is that if you go over your mileage agreement or the car is damaged beyond the normal ‘wear and tear’, there will be added costs.

Personal Loan

A personal loan may be the least expensive option if you meet the criteria to apply. Typically, you should have a good credit score and a decent salary in order to proceed, but it gives you a considerable amount of flexibility versus HP, PCH, and PCP.

The easiest way to go about it would be to contact your bank and speak to them about taking out a loan towards the purchase of a car. Depending on your situation, you may get a fairly decent interest rate. A personal car loan means that you own the car, and you aren’t restricted with mileage, keeping it in a particular condition, or having any sort of final hand off.

So if the car you’re looking to purchase costs £40,490, and you can put in £10,000 of your own savings, you can talk to you bank about offering you a loan of £30,490. Let’s say you snag an interest rate of 3.4% and you’re willing to pay it off over 36 months. You’d be look at about £875/month that by the end of your loan payment, you would have put roughly £41,530 into the car, but it would be yours without further effort.

Cash

This option is fairly straightforward. A car costs £40,490 and you pay…well…£40,490. It’s a doable option if you are looking to purchase a used car or one that is relatively inexpensive and you have saved up for. You don’t need to worry about interest rates or talking to banks, but you still need to be mindful what you’re buying.

Should I buy new or pre-owned?

The argument for a new car seems strong without having to do much work. A new car smell, something shiny and the availability of more finance options. Newer cars are typically safer than older ones, and you can customize to your hearts desire when you opt for something right out of a dealership. You may, however, face greater depreciation, higher premiums, and, well, a greater cost.

Older cars won’t be as expensive, and they tend to be readily available as well as potentially cheaper to insure. That being said, maintenance costs may be higher.

Car Insurance, V5C, and MOT

Naturally the cost of a car comes with a package of upkeep, insurance, and tax. Vehicle excise duty or car tax or road tax is one cost you will need to take into account from day one. There is information you can get on the vehicle certification agency site to help you understand what your tax would be for your particular make and model.

You’ll also need to ideally get your car serviced once a year, and you’ll need to get a Ministry of Transport (MOT) test done. If you don’t have a valid MOT, you will be fined £1,000, so keep a reminder to let you know when you are due. You can also check the status of your MOT to ensure you don’t miss out.

And let’s not forget the recurring cost- insurance! It’s against the law to drive without insurance, but it can be pricey. That’s why it’s a good idea to cross-reference insurance plans from websites like MoneySuperMarket or ComparetheMarket.

Your V5C is your car logbook that confirms ownership. It also has specific details of the vehicle. If you sell your car, you need to inform the DVLA to confirm change in ownership.

NHS Fleet Solutions

As a member of the NHS, you can get quite a few perks, but one of the most coveted advantages is the NHS fleet solutions. It is another option you can consider if you want to buy a car in the UK. You are leasing a car through your hospital/trust for reduced rates and the following:

You don’t own the vehicle, rather the leasing company owns it, but it is ideal for someone who is in a permanent or long term contract at a hospital. The cost is taken as a salary sacrifice, which means that the monthly deduction is taken before tax from your paycheck- meaning less take home pay, less pension contribution, and less National Insurance.

There are some drawbacks. The fleet website states that it can take around 10-16 weeks for the car to arrive, there is an early termination fee as well as a mileage limit, and the car is assessed up return for any damage (meaning you may have an extra cost if not found to be within normal wear and tear). You have the option to purchase the car at the end of the contract if you wish.

What Option Should I Choose?

What you need to take into account is first how much you’d be willing (and able) to pay as a monthly payment. Then you need to consider if you would want to buy the car in the UK at the end of the contract. Another thing you need to be aware of is if your credit score would be looked into and if you’d secure a good loan if you were to take that route.

Really take the time out to do your homework when it comes to making this decision. Don’t take it lightly and just assume if one route worked for a friend then it would be ideal for you. Everyone has their own costs and needs, and as such, they have different budgeting and savings needs.

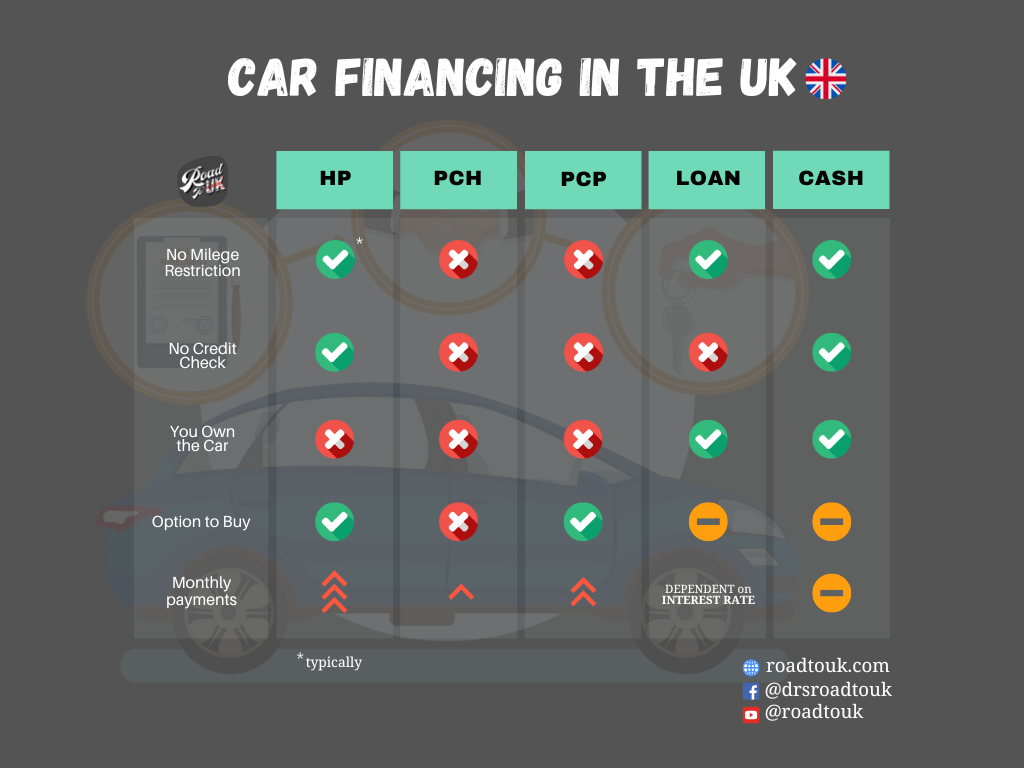

You can get a general rundown of HP vs PCH vs PCP vs Loan vs Cash from the chart below:

Tips & Advice

Just some final takeaways when you buy a car in the UK:

- Don’t rush into purchasing a car until you’ve weighed all of your options

- Don’t keep a monthly payment that will be difficult for you to pay

- Negotiate and haggle as much as you can to get the deal that you want

- Test drive a car before you settle on it

- Keep an eye out for price reductions, end of year events, and opportunities for upgrades at no extra cost

- If you intend on purchasing a car after a contract plan, ensure it has a good resale value

- Look into if the dealership you buy from has good trade-in options

Happy bargain hunting!